Getting a medical bill can feel overwhelming, especially when the numbers don't seem to add up. But here's some good news: you don't need to be a medical billing expert to catch many common errors. In fact, studies show that up to 80% of medical bills contain mistakes, and many of these are surprisingly easy to spot if you know what to look for.

Your Explanation of Benefits (EOB) – that document your insurance company sends that says "This is not a bill" – is actually your best tool for catching these errors before you pay. (New to EOBs? Check out our what is an EOB?) Think of it as your financial safety net. By taking a few minutes to review your EOB alongside any medical bills you receive, you can potentially save yourself hundreds or even thousands of dollars.

1. Insurance Already Paid, But You're Still Being Billed

What to look for: Your EOB shows that insurance already paid for a service, but the healthcare provider is still sending you a bill for that same service.

This is one of the most frustrating errors because it feels like you're being charged twice for the same thing. It often happens when there are delays between when your insurance processes the claim and when the provider's billing system updates. Sometimes payments get misapplied to the wrong account, or there's simply a communication breakdown.

Red flag example: Your EOB shows "Insurance paid: $500" for a lab test, but you receive a separate bill from the lab demanding $500 for the same test on the same date.

What to do: Call the provider's billing department and ask them to verify that the insurance payment was properly applied to your account. Don't pay until this is resolved.

2. EOB Amount vs. Medical Bill Amount Don't Match

What to look for: The amount your EOB says you owe doesn't match what the healthcare provider is billing you.

Your EOB essentially tells you "here's what you should expect to pay," while the medical bill says "here's what we're asking you to pay." These numbers should match. When they don't, it's a clear signal that something went wrong in the billing process.

Red flag example: Your EOB shows "Patient responsibility: $150" but the medical bill asks for $400.

What to do: Don't pay the higher amount until you resolve the discrepancy. Contact both your insurance company and the provider to figure out where the disconnect happened. Most billing departments are used to helping resolve these mismatches.

3. Billed for Services You Never Received

What to look for: Your EOB lists procedures, tests, or services that you don't remember having.

Medical billing uses complex codes, so don't worry if the descriptions sound technical – but you should recognize the basic type of care. If your EOB shows you had an X-ray but you only had a blood test, that's a problem.

Red flag example: You went in for a routine check-up, but your EOB shows charges for an EKG, blood panel, and vision screening that never happened during your visit.

What to do: Request an itemized bill from your provider and compare it to your own records of what actually happened. Don't hesitate to ask your doctor's office to walk through each charge with you – they should be able to explain every service listed.

4. Duplicate Charges for the Same Service

What to look for: The same service appears multiple times on your EOB, especially when it should only appear once.

This is particularly common in hospital stays where multiple departments might bill separately, or in situations like childbirth where both mother and baby receive care in the same location.

Red flag example: Room and board charges appear on both mom's bill and baby's bill for the same hospital room during delivery, even though they shared the space. Another common example is being charged twice for the same medication or lab test.

What to do: Ask for an itemized explanation of each charge. Services that benefit multiple patients or are shared (like hospital rooms) should typically only be billed to one person, not duplicated across multiple bills.

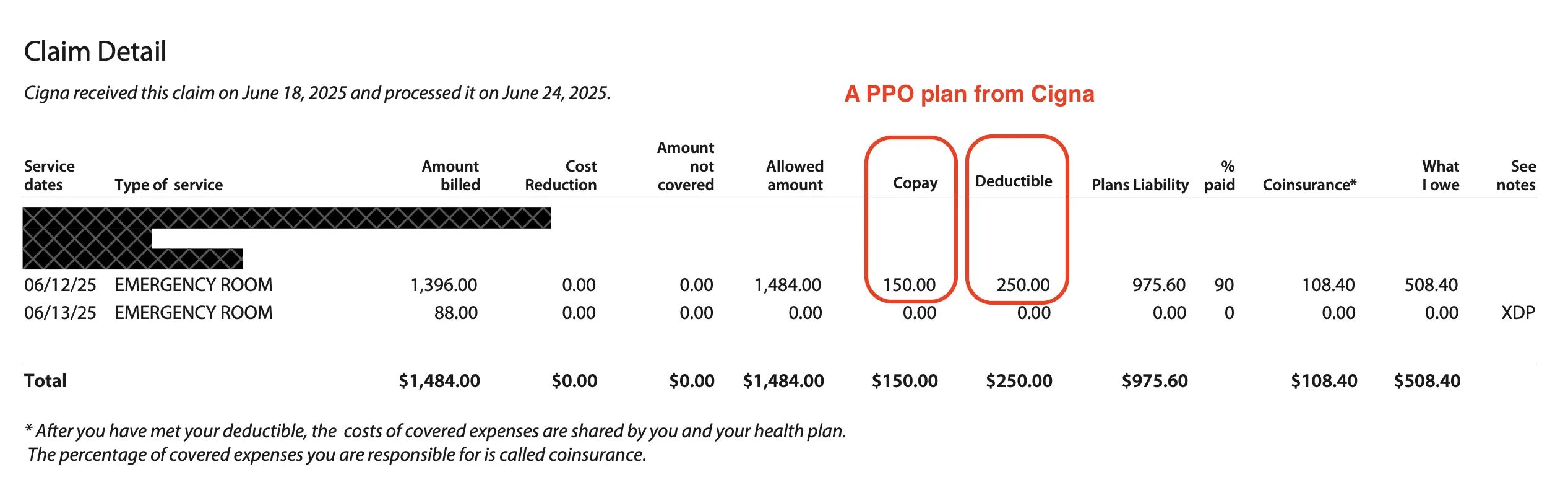

5. Both Copay and Deductible Charged for the Same Service

What to look for: Your EOB shows both a copay and deductible amount for a single service or visit.

In most insurance plans, you pay either a copay OR a deductible for a service, not both. Copays are fixed amounts (like $20 for an office visit), while deductibles are amounts you pay before insurance kicks in. Being charged both for the same service is unusual and worth questioning.

Red flag example: Emergency room visit shows a $150 copay AND a $250 deductible on the same line item, resulting in an unexpectedly high patient responsibility.

Example of a Cigna EOB document

What to do: Call your insurance company to understand your specific plan's cost-sharing structure. While some high-deductible plans work differently, they should be able to clearly explain why both charges apply. If they can't provide a clear explanation, you may have found an error.

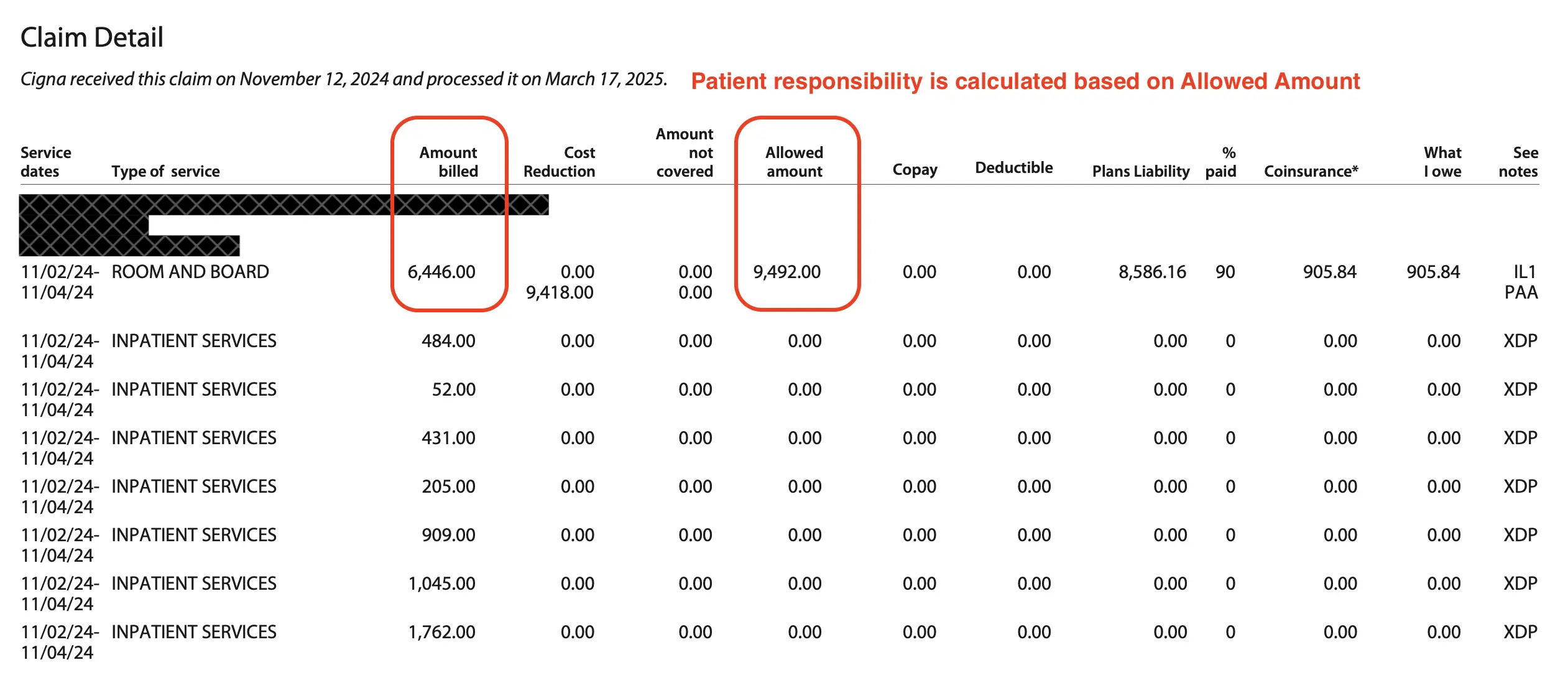

6. Allowed Amount Higher Than Billed Amount

What to look for: The "allowed amount" on your EOB is higher than the "billed amount" – which is backwards from how it should work.

This one's more technical, but if you spot it, it's almost certainly an error. Healthcare providers typically bill high amounts, then insurance companies negotiate them down to a lower "allowed amount." When the allowed amount is higher than what was billed, it suggests a data entry error or system glitch.

Red flag example: Provider billed $6,000+ for a service, but your EOB shows an allowed amount of $9,000+ for the same service.

Example of a Cigna EOB document

What to do: This is almost always a processing error on the insurance side. Call your insurance company and ask them to review and reprocess the claim with the correct amounts. The math simply doesn't work when the "negotiated rate" is higher than the original bill.

Don't Panic – Take Action

Finding an error on your EOB is unfortunately common. While some errors are genuine mistakes, the current healthcare billing system often works in providers' favor, not yours. The key is catching these errors before you pay.

Your Simple Action Plan:

- Always wait for your EOB before paying medical bills

- Compare EOB amounts to provider bills line by line

- Keep simple records of your healthcare visits (dates, what was done)

- Don't be afraid to ask questions – billing departments expect patient inquiries

- When in doubt, call both your insurance company and healthcare provider for clarification. Or you can ask FairBilling Advocate to work on your behalf

Remember, you have every right to understand what you're being charged for. Healthcare providers and insurance companies should be able to explain their charges in plain English. If they can't, or if something still doesn't add up after their explanation, consider getting help from a patient advocate or medical billing specialist.

Found a Billing Error?

If you've spotted one of these errors but feel overwhelmed dealing with insurance companies and billing departments, we're here to help.

Get Professional Help →