If you've ever been confused by a document from your insurance company that looks important but isn't a bill, you've probably encountered an EOB. You're not alone in finding these documents puzzling – most people have no idea what they're looking at or what to do with them.

What Exactly is an EOB?

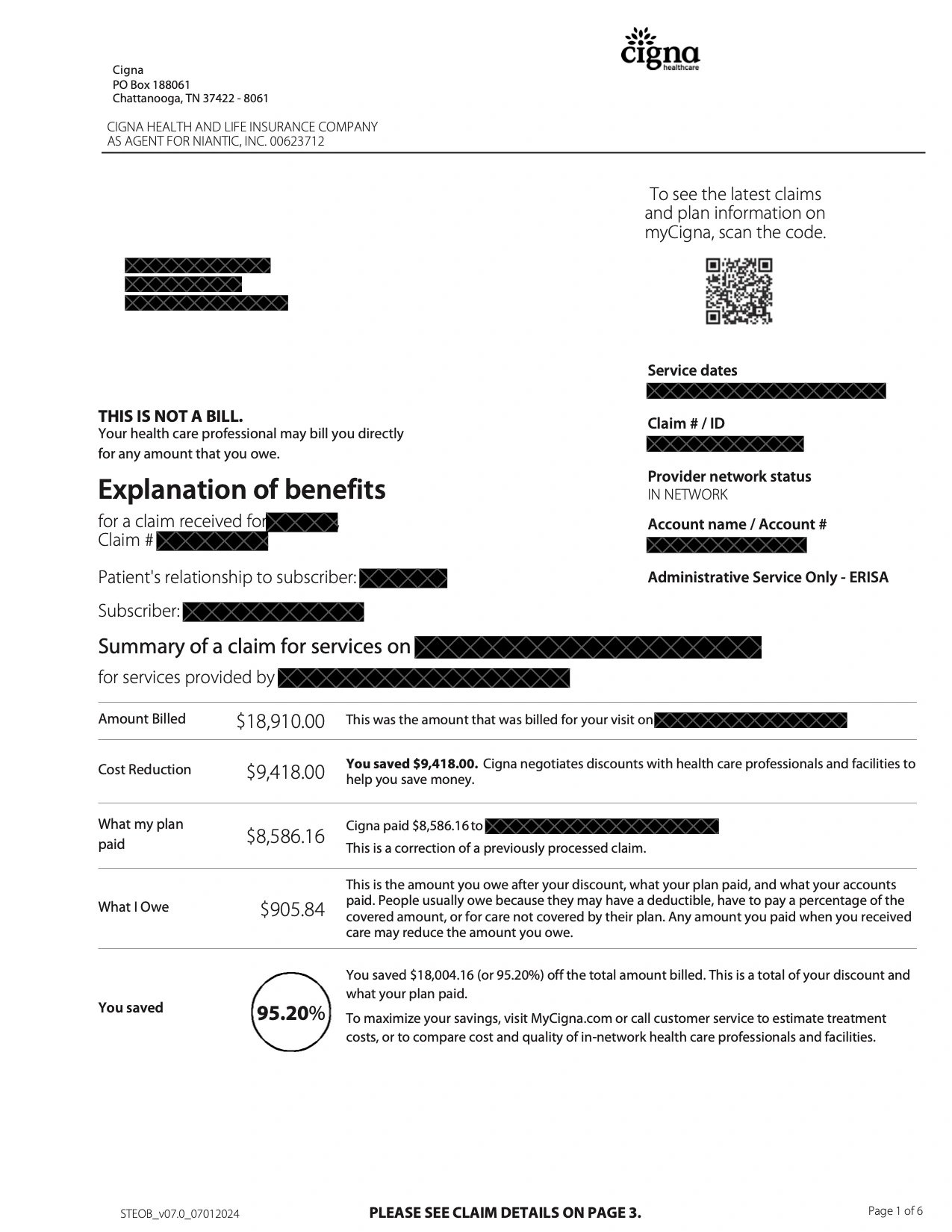

An EOB stands for "Explanation of Benefits." It's a document your insurance company sends you after they process a healthcare claim. They are required by law to send you EOBs for transparency. Think of it as your insurance company's report card showing what happened when your doctor or hospital submitted a bill to them.

The EOB breaks down what services you received, how much the provider charged, how much your insurance paid, and what (if anything) you might owe. It's not a bill – it's an explanation of what your insurance company did with the bills they received on your behalf.

Example of a Cigna EOB document

Why Medical Bill Advocates Need Your EOB

If you're facing a billing dispute, your EOB is one of the most important documents a medical bill advocate needs to help you. Here's why:

The EOB shows exactly what your insurance company paid and when they paid it. This allows advocates to identify discrepancies when hospitals or clinics claim they weren't paid or demand additional payment. Your EOB serves as proof of payment and helps advocates understand whether a billing error has occurred.

Without your EOB, it's nearly impossible to determine if you're being overcharged, double-billed, or asked to pay for services your insurance already covered. The EOB is essentially the "receipt" that proves what your insurance company's role was in paying your medical bills.

When Should You Expect to Receive an EOB?

You should receive an EOB within 30 days after your insurance company processes a claim. This usually happens:

- After a doctor's visit

- Following a hospital stay

- After lab work or diagnostic tests

- When you pick up prescription medications (sometimes)

- After any medical service covered by your insurance

The timing can vary – sometimes you'll get your EOB before the provider's bill arrives, sometimes after, and sometimes around the same time.

How to Access Your EOBs

Most insurance companies offer multiple ways to access your EOBs:

Online Portal: Log into your insurance company's website or mobile app. EOBs are usually found in a section called "Claims," "Benefits," or "Documents."

Mail: If you haven't opted for electronic delivery, EOBs arrive by mail at the address on file with your insurance company.

Phone: You can call the customer service number on your insurance card and request that EOBs be mailed or emailed to you.

Email: Many insurers will email EOBs if you sign up for electronic delivery in your online account.

Why Didn't I Get an EOB?

Several reasons why you might not receive an EOB:

Claim not processed yet: If your provider hasn't submitted the claim to insurance, or if it's still being processed, no EOB will be generated.

Direct payment services: Some routine services (like annual physicals) might be paid directly without generating a detailed EOB.

Address issues: If your insurance company has an outdated address or email, you might not receive EOBs.

Electronic delivery settings: You might have signed up for electronic delivery but aren't checking the right place online.

Claim denied: Sometimes a lack of EOB indicates your claim was denied or rejected entirely.

If you're missing EOBs, contact your insurance company directly to ask about specific claims.

Frequently Asked Questions

What's the difference between a bill and an EOB?

A bill is a request for payment from your healthcare provider. An EOB is an explanation from your insurance company about what they paid. You might receive both for the same medical service – the EOB shows what insurance covered, and the bill shows what you still owe.

How long should I keep my EOBs?

Keep EOBs for at least one year, but ideally three to seven years. You might need them for tax purposes, to resolve billing disputes, or to track your medical history. Store them with your other important medical and financial documents.

Can I access my old EOBs from several years ago?

Most insurance companies keep EOBs available online for 12-24 months. For older EOBs, you'll typically need to call customer service and request copies. Some insurers charge a small fee for EOBs older than two years, so it's worth keeping your own copies.

Understanding your EOB is the first step to taking control of your medical billing. In our future article, we'll dive deeper into how to read and interpret every section of your EOB so you can spot errors and understand exactly what you're looking at.